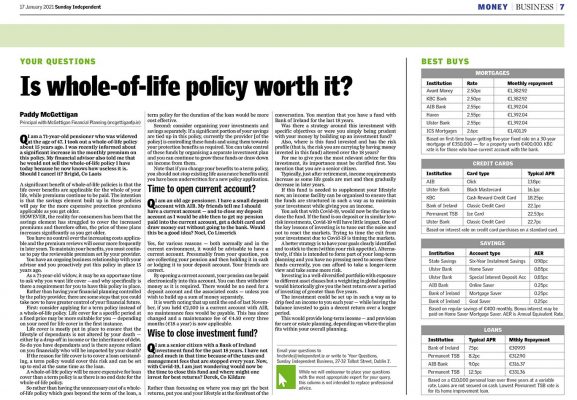

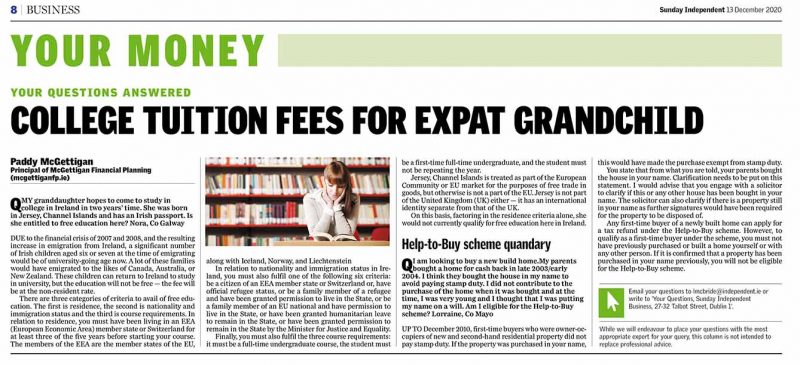

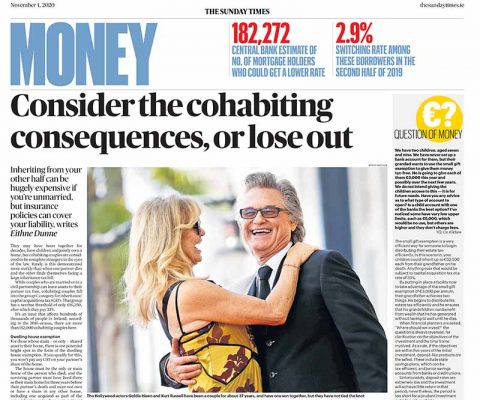

We are a Financial planning business. We build long term relationships with our clients and take time to understand their financial goals.

Our aim is to educate and advise clients about all aspects of their financial wellbeing, focusing primarily on asset management and personal finance.