Your Investments are the engine of your financial plan. The portfolio that we build and manage for you will be with your goals as the primary focus.

The intention is always to create financial independence for you and your family.

Investment Principles:

- What are you investing and saving for? Identify your goals , this will have a direct impact on how your money is invested.

- Clarify the time frame of your investment.

- Before Saving and Investing , clear trivial debt and build an emergency fund.

- Distinguish between Risk & Volatility

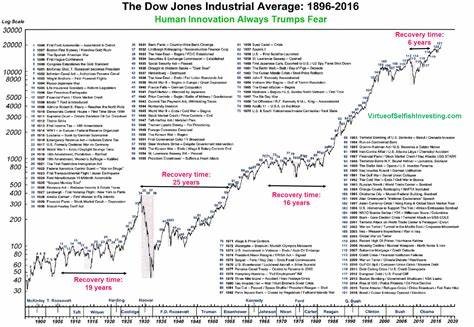

– Risk and Return go hand in hand. The longer the time period you can afford to invest, the greater the risk you can take and the greater the return you will make.

– People confuse risk with volatility.

– Volatility is the journey. It will involve temporary declines. Risk is a permanent loss of capital.

– We regularly see the stock market move up and down, but the market itself is continuously evolving. - The risk of the stock market is not being invested in it. Stock market volatility is always temporary and part of the investment process. Declines in the Stock Market are temporary, new companies are continually being developed , the advance of the stock market is permanent.

6. Focus on Time in the markets . Do not try to Time the markets.

7. Tune out the noise.

8. Stick to the plan. Continuously go back to your goals and recap on why you are investing. The successful investor sticks to the Plan the failed investor reacts to the markets.

“The individual investor should act consistently as an investor and not as a speculator.”

. . . Ben Graham