Q: ‘The rent from a flat I let no longer covers my mortgage. Must I sell?’ I have a two-bed apartment in Dublin that I bought during the Celtic Tiger with a tracker mortgage that’s 1pc over the ECB rate. The property is in a Rent Pressure Zone and the monthly rental income is €1,500…..read more

Category Archives: Independent Articles

Q: I’m 55 and I’ve had a significant portion of my pension savings invested in an equity portfolio for the last 15 years. This year, with volatility across the markets, my annual return has been negative. I had hoped to retire in ten years, so I am worried I will lose more of the savings….read more

Q: I’m 55 and I’ve had a significant portion of my pension savings invested in an equity portfolio for the last 15 years. This year, with volatility across the markets, my annual return has been negative. I had hoped to retire in ten years, so I am worried I will lose more of the savings….read more

Q I am working in the private sector on a modest salary but have always been careful with my money and able to manage quite well. However, I am starting to feel the pinch each month and can see my weekly shop going up all the time. Some experts are warning inflation could be more….read more

Q The cost-of-living crisis has me really struggling to make ends meet. I’m on a reasonably good wage but my commute into work is now costing me considerably more. I’m in danger of falling behind on my mortgage or car loan if things continue as they are. I’m currently paying 5pc of my salary into….read more

The biggest advantage of buying an annuity at retirement is that you are guaranteeing a level of income for the rest of your life. Stock image Q. I’m in my early Sixties and will retire in a few years. I’ve been paying into a work pension (defined contribution) for most of my working life and….read more

Q. We have accumulated about €40,000 in savings, currently sitting in our bank account. We don’t want to leave it there because of the threat of inflation and possible negative interest rates. Yet we don’t want to invest it either because we think we might need it in the next few years. Some of it….read more

Q. My partner and I had planned to go abroad in summer 2020 and work for between one and two years. Covid obviously put an end to that – but we are hoping we can travel early in 2022. We currently have combined savings of €80,000 and are each saving €1,000 per month. We are….read more

Unlike in the 1989 film Back to the Future Part II, starring Thomas F Wilson as young and old Biff, those in retirement will not be able to travel back in time to help their younger selves with money worries. As new rules lower final retirement pot forecasts, Eithne Dunne asks how you can maximise….read more

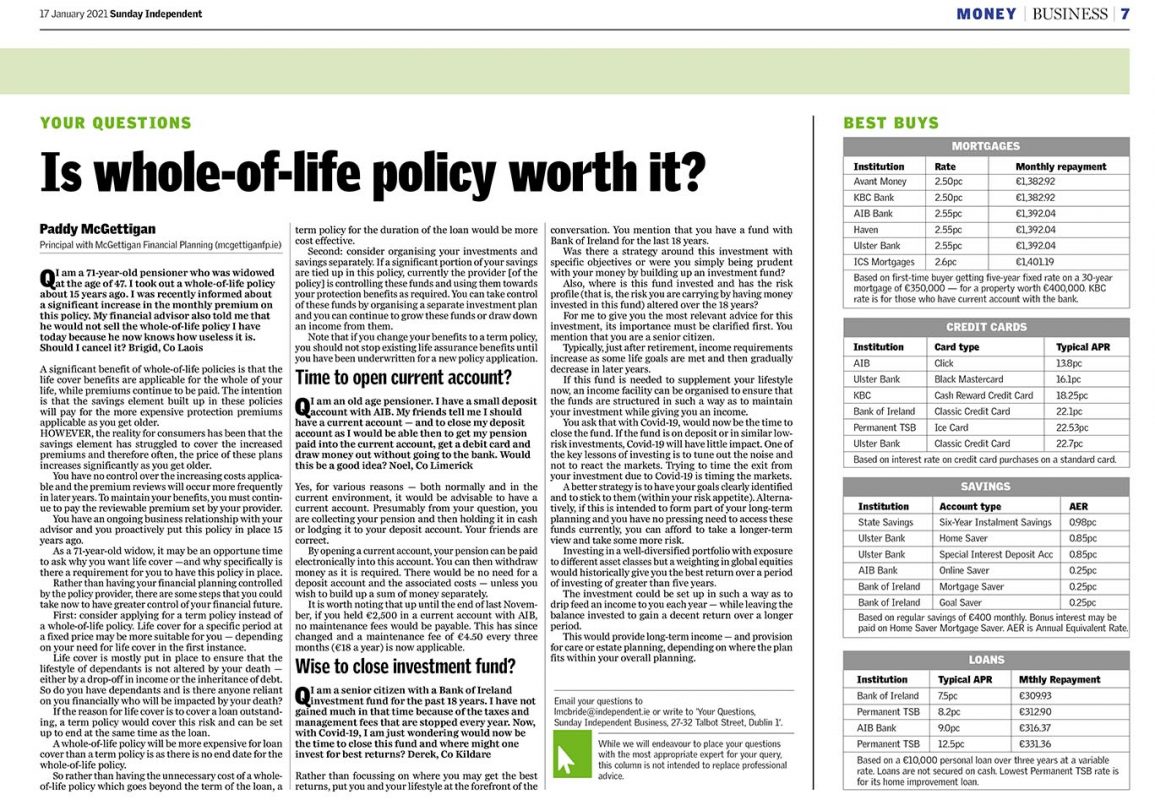

Is whole-of-life policy worth it? I am a 71-year-old pensioner who was widowed at the age of 47. I took out a whole-of-life policy about 15 years ago. I was recently informed about a significant increase in the monthly premium on this policy. My financial advisor also told me that he would not sell the….read more

- 1

- 2